The trend seen in previous months continued throughout August. Both crude steel and rolled steel production recorded declines, as did apparent consumption. Although imports fell in August, they remain strong for 2025. Meanwhile, exports continued to show weakness and in August recorded their lowest level for that month since 2011. As a result, the Latin American steel industry’s trade balance was in deficit, accumulating 16.2 MT so far this year.

Steel production in LATAM continues to show a negative trend. While crude steel production in the eighth month of the year totaled 4.6 Mt, registering a year-on-year decline of -6.2%, rolled steel production fell by -11% annually, and a cumulative -3.2% compared to the same period last year.

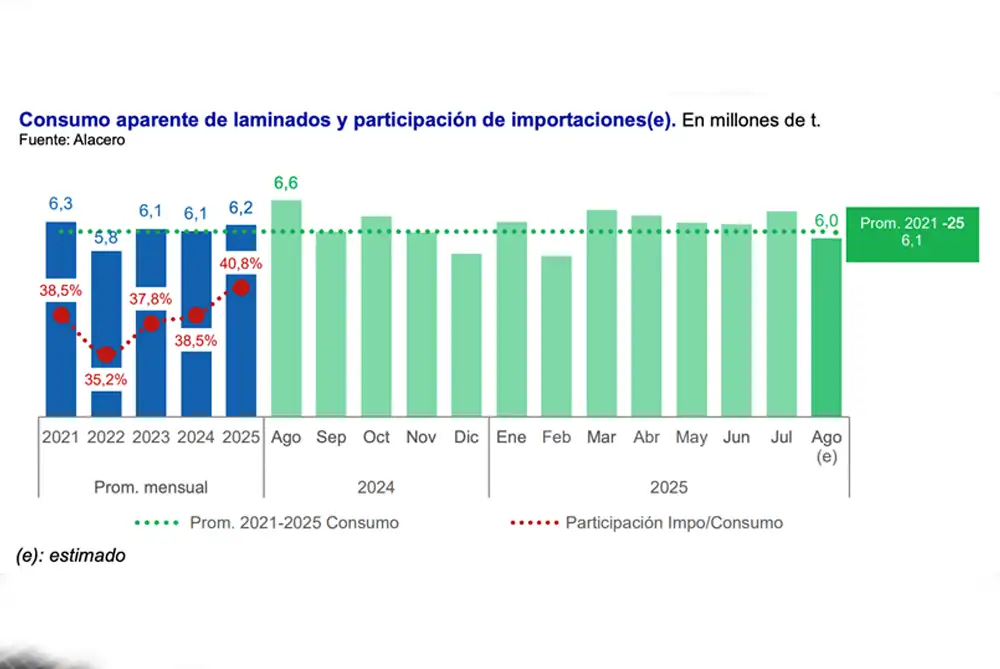

Apparent consumption of rolled products reached 6.0 Mt in August, down -9.4% compared to August 2024. As a result, it totaled 49.7 Mt in the January-August period, up +1.6% year-on-year. Five of the six major economies in the region showed increases in this period, with the exception of Mexico.

In terms of imports, although they fell in August compared to the same period last year, strong growth is still expected for 2025. In August, foreign purchases fell by 6.1% year-on-year, with a total of 2.4 Mt. Argentina and Brazil saw increases in imports, while Mexico showed a contraction. Year-to-date, there has been a 7.0% increase compared to the same period last year.

During August, LATAM exported 0.43 Mt of rolled products, representing a year-on-year decline of -16.0%. As a result, the region’s trade balance was in deficit by 1.9 Mt in August, accumulating 16.2 Mt in the eight months.

For steel-demanding sectors, the outlook remains complex, with negative indicators in almost all areas. Construction, machinery, and household products have been accumulating declines. However, after two months of decline, the automotive sector showed an increase in September.