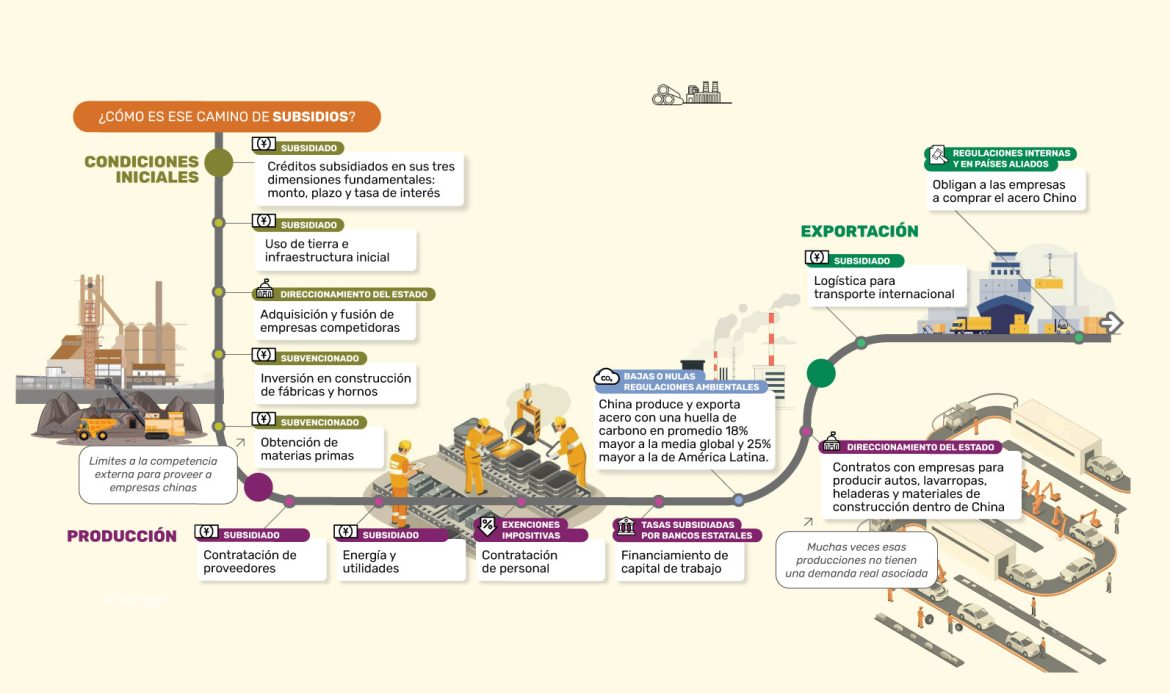

We present an infographic that analyzes the critical situation facing the steel industry in Latin America and shows how overproduction and the complex web of subsidies, particularly those allocated by China to steel, create unfair trading conditions.

While crude steel production in Latin America fell by 13% between 2021 and 2024, the share of rolled steel imports over consumption reached record levels of 40.3% during the first half of 2025.

Over the last 15 years, Chinese steel exports to Latin America grew by +233%. Indirect steel exports (the content in finished products such as appliances or machinery) increased by 338% between 2008 and 2024.

The analysis of China’s case shows how steel overproduction does not respond to supply and demand, but rather to the premise of generating employment and development in the country. This is possible thanks to various subsidies—fiscal, regulatory, commercial, infrastructure, and more—that favor its industry, which can sell to the world below actual production costs.

This situation has repercussions throughout the Latin American value chain, flooding markets with Chinese products, affecting local employment and production, and accelerating a process of deindustrialization. The region’s industrial GDP has fallen by 4% since the 1990s, and Latin America has lost 5.3 percentage points in the share of manufactured goods in its total exports, falling from 52.8% (average 2000-2009) to 47.2% (average 2020-2023).

In the words of Ezequiel Tavernelli, executive director: “Latin America needs a comprehensive strategy together with countries and regions that share our market rules to ensure a solid and sustainable industrial future on our continent.”

We believe that this material is a key resource for understanding the dynamics of unfair competition and the strategic challenges facing our industry.