In a slowing global economy, the region’s GDP growth is below the world average (+3.4%) and will be in line with the expansion in 2024 (+2.4%).

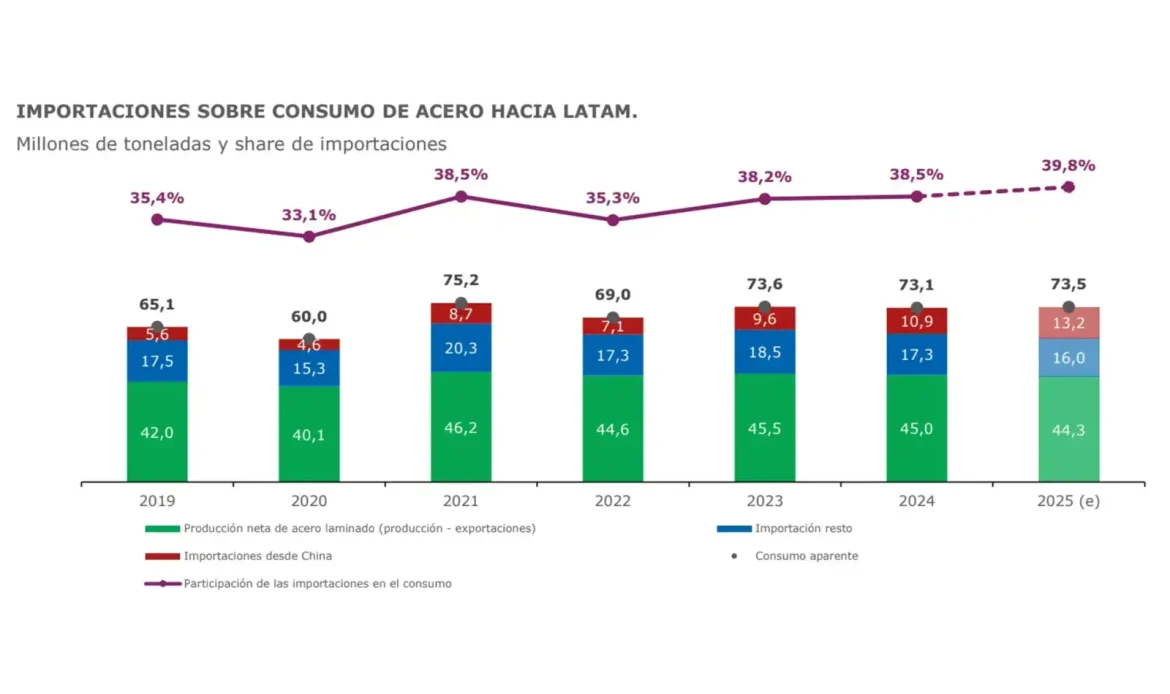

Projected rolled steel production is down, while imports are expected to reach record levels.

The growth of exports by countries with unfair economies, rising tariffs, and regulatory uncertainty, coupled with local structural difficulties, are impacting the region and continuing the trend of deindustrialization.

Foreign purchases continue to put pressure on regional industry, in a context of unfair competition with products that often enter from non-market economies, which subsidize their production and provide financial support outside the WTO framework. China accounts for 45.4% of total imports in Latin America, weakening intraregional trade.

Latin America must implement an agile and effective trade defense strategy. According to the OECD, the Chinese steel industry receives subsidies up to 10 times higher than those of its member countries, ranging from credit, energy, and raw materials to logistics and exports.

This allows it to flood the international market with steel at prices below its actual cost, particularly affecting regions such as Latin America, where the lack of effective trade defense measures leaves the industry exposed to unfair trade practices.

Apparent consumption of rolled steel is expected to remain stable, reaching 72,7 Mt (-0,6%) in 2025. This result reflects differing dynamics across the region: while countries such as Argentina and Brazil are expected to recover this year, others such as Mexico and Colombia are expected to suffer declines. Among the sectors demanding steel, construction leads with 49,2%of the total in the region, driven mainly by Brazil, followed by the automotive and metal products industries. However, variations in consumption and production between countries reflect a heterogeneous picture.