During October, steel production—both crude and rolled—continued to decline, following the trend of previous months. Exports showed weakness and recorded negative balances, while imports revealed positive balances. Apparent regional consumption continued to fall, with foreign purchases representing 40.6% of apparent consumption, consolidating record levels for the historical series.

Crude steel production was 4.7 Mt, with a year-on-year decline of −4.9% and a cumulative decline of −2.7% for 2025. Rolled steel also declined, both in the tenth month of the year with −5.3% compared to the same period last year and in the annual cumulative with −3.9%.

Apparent consumption of rolled steel in Latin America reached 6.3 Mt, with a year-on-year decline of −1.1%. However, during 2025 there was a positive balance of +1.3% y/y. Four of the five main economies in the region showed increases during these ten months.

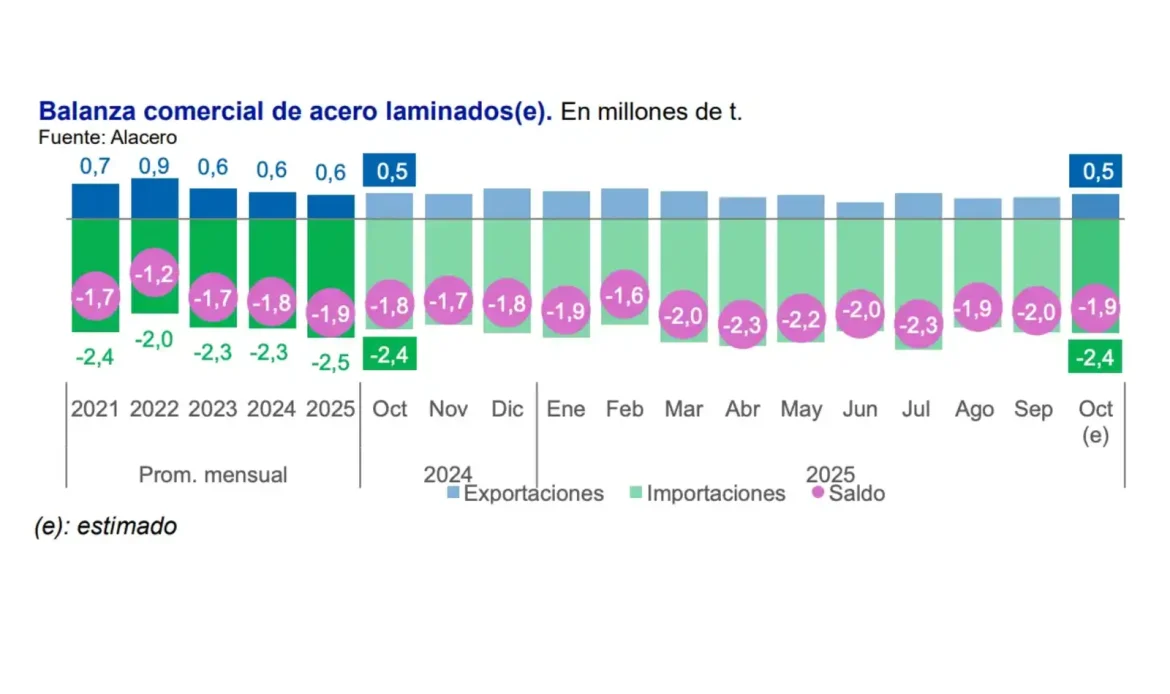

Imports rose by +2.9% in October compared to the same month last year. Annual growth was +7.5%, with notable increases in Brazil, Chile, and Argentina. On the other hand, exports showed a downward trend with a total of 0.5 Mt in October, representing a year-on-year variation of −2.5% and a decline of −9.2% y/y in the year to date. As a result, the regional balance was in deficit.

In relation to steel-consuming sectors, preliminary data for the month suggest a slight rebound in construction at the regional level, after three months of decline. For their part, industrial sectors continue to show mixed dynamics: machinery advanced +3.7% year-on-year, while domestic use fell -1.7% year-on-year, recording its seventh consecutive annual decline. In November, the automotive sector recorded its largest year-on-year decline for a month so far in 2025, with a drop of -9.4%.