In November 2025, the sector’s performance showed a change in the trend of previous months: crude steel and rolled steel production remained stable (+0.4% year-on-year, 4.7 Mt; and +0.0% year-on-year, 4.3 Mt, respectively), while imports fell by −1.6% year-on-year (2.2 Mt). Regional apparent consumption fell again for the fourth consecutive month (−1.6% y/y; 6.0 Mt). In the first 11 months of the year, external purchases reached 40.3% of apparent consumption, consolidating a record share in the historical series.

Crude steel production in November was 4.7 Mt, marking a variation of +0.4% y/y, and a cumulative decline of -2.4% between January and November. Rolled steel production was 4.3 Mt, accumulating a contraction of −3.5% between January and November compared to the same period last year, with mixed performances among products: flat products showed increases, while long products and seamless tubes declined.

Apparent consumption reached 6.0 Mt in November 2025 (-1.6% y/y), maintaining a slight expansion of +1.1% y/y in the cumulative total from January to November (68.2 Mt). Five of the six main economies in the region showed increases, with Argentina and Brazil standing out.

Import figures showed a year-on-year decline of -1.6% in November. However, the cumulative total for the year is +6.8% y/y, with notable increases in Brazil (+20.6%) and Argentina (+41.6%), while Mexico continues to decline (-14.6% y/y). In the first 11 months of the year, foreign purchases reached 40.3% of apparent consumption, consolidating a record share in the historical series.

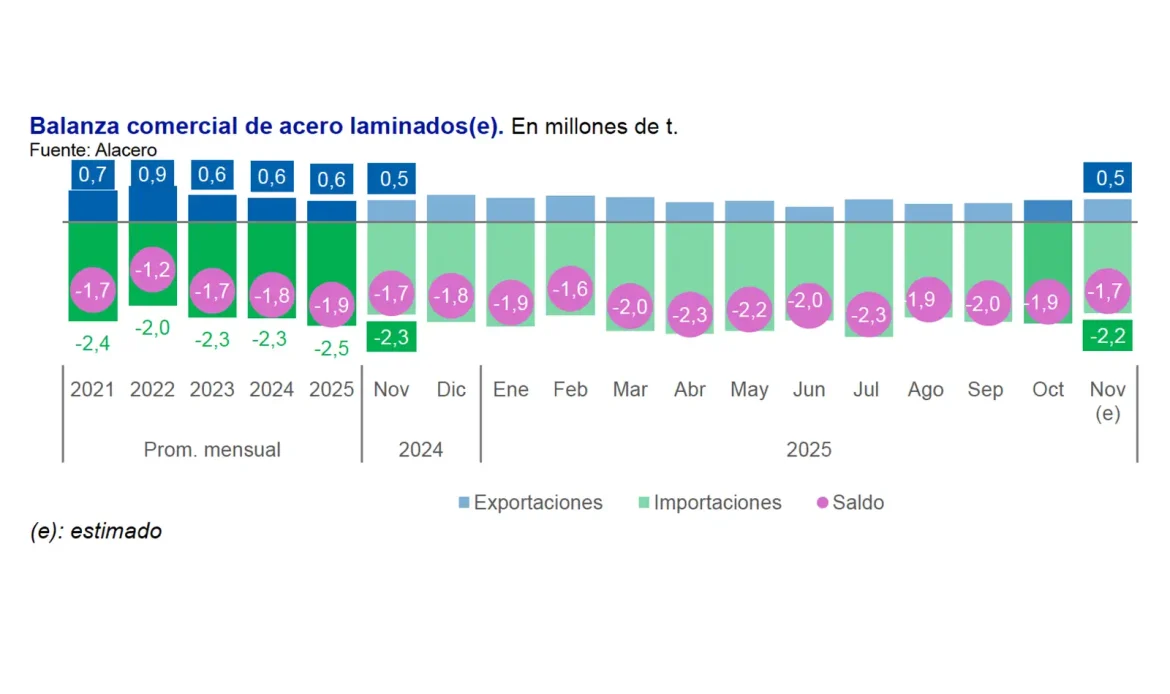

In turn, exports remained weak at 0.5 Mt, with a cumulative decline of -8.3% y/y. As a result, the trade balance recorded a deficit of 1.7 Mt in November, totaling 21.9 Mt in the January-November 2025 period.