In September, monthly figures for the sector remained down, continuing the trend of previous months. Crude steel and rolled steel production continued to decline, while imports totaled an 11.6% year-on-year increase. Foreign purchases now account for 40.9% of apparent consumption, reaching record levels in the historical series since 2011.

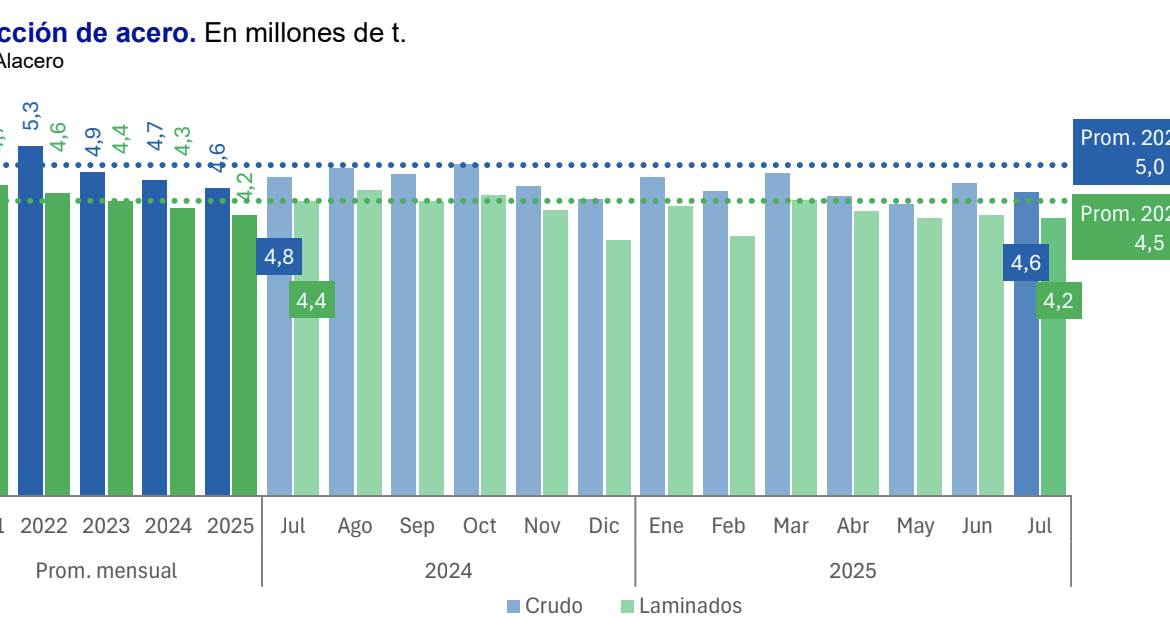

Crude steel production stood at 4.5 Mt, down 5.9% year-on-year, and rolled steel production also declined, both in the ninth month of the year (-7.9% y/y) and in the year-to-date figure (-3.7%).

Apparent consumption reached 6.0 Mt, with a year-on-year decline of -1.8% compared to the same period last year. Although it shows a negative balance, there is still a slight expansion of +1.4% y/y in the January/September-25 cumulative total. Five of the six major economies in the region showed increases in these 9 months; Except for Mexico that presents a decrease of -9.9% y/y.

Exports remained weak, with a cumulative decline of -8.8% y/y so far this year, while imports showed a year-on-year increase of +11.6% in September-25, with Brazil and Argentina standing out, while Mexico continues to decline (-13.1% y/y). As a result, the regional balance showed a deficit of 1.9 Mt in September.

In relation to steel-consuming sectors, preliminary data from september suggest a further decline in construction at the regional level and mixed performance in industrial sectors. Automotive and domestic use also recorded negative balances.